japan corporate tax rate 2017

The local standard corporate tax rate in Japan is 234 and it applies to normal companies with a share capital which exceeds JPY 100 million USD 896387. Current Japan Corporate Tax Rate is 4740.

Choose a specific income tax year to see the Japan income tax rates and personal allowances used in the associated income tax calculator for the same tax year.

. Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes Residence A company that has its principal or main office in Japan is considered to be resident. But if the company is Medium and small sized company the taxable income limitation does not apply. Japan Corporate Tax Rate for Dec 2017.

Employee Social Insurance Contribution Rate. Business tax comprises of three variables Regular business tax special local corporate tax and size-based business tax. The tax credit for the promotion of income growth and the tax credit for job creation may be taken in the same fiscal year if certain adjustments are made.

96 67 96 70 Local corporate special tax or special corporate business tax the rate is multiplied by the income base of size-based enterprise tax which is national tax. 50 of taxable income. Corporation tax is payable at 239 percent.

1 If a company has capital in excess of 100 million Japanese yen or is a wholly owned subsidiary of a large corporation with capital of more than 500 million Japanese yen the company is treated as large corporation under corporate tax. Tax notification must also be submitted when a foreign corporation generates income subject to corporate tax in Japan without establishing a branch office ie where 2 of 334 Table 3-5 applies. The corporate tax rate in Japan for a branch is the same as for a subsidiary.

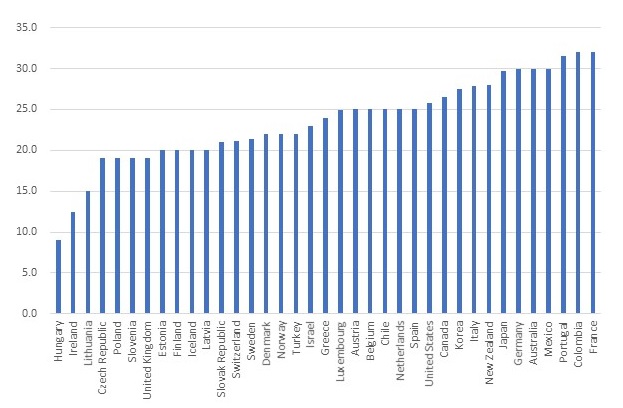

A Look at the Markets. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019. 60 of taxable income.

Effective Corporate Tax Rates With Alternative Allocations of Asset Shares in G20 Countries 2012 34 Figure B-2. Benchmark Treasury yield hits 3-yr high. Tax rates for companies with stated capital of JPY 100 million or greater are as follows.

Japan Corporate Tax Rate History. 332 Corporate income taxes and tax rates The taxes levied in Japan on income generated by the activities of a corporation include corporate tax. The Japanese statutory corporate tax rate actually declined to below 30 in 2016 from around 50 in the middle of the 1990s but its tax base has yet to fully broaden mainly due to the introduction of new specialpreferences and tax incentives.

Reform to Japan corporate income tax tax incentives directors compensation and similar rules to increase the competitiveness of Japanese business globally. Tax year beginning between 1 Apr 201631 Mar 2017. Tax year beginning between 1 Apr 201731 Mar 2018.

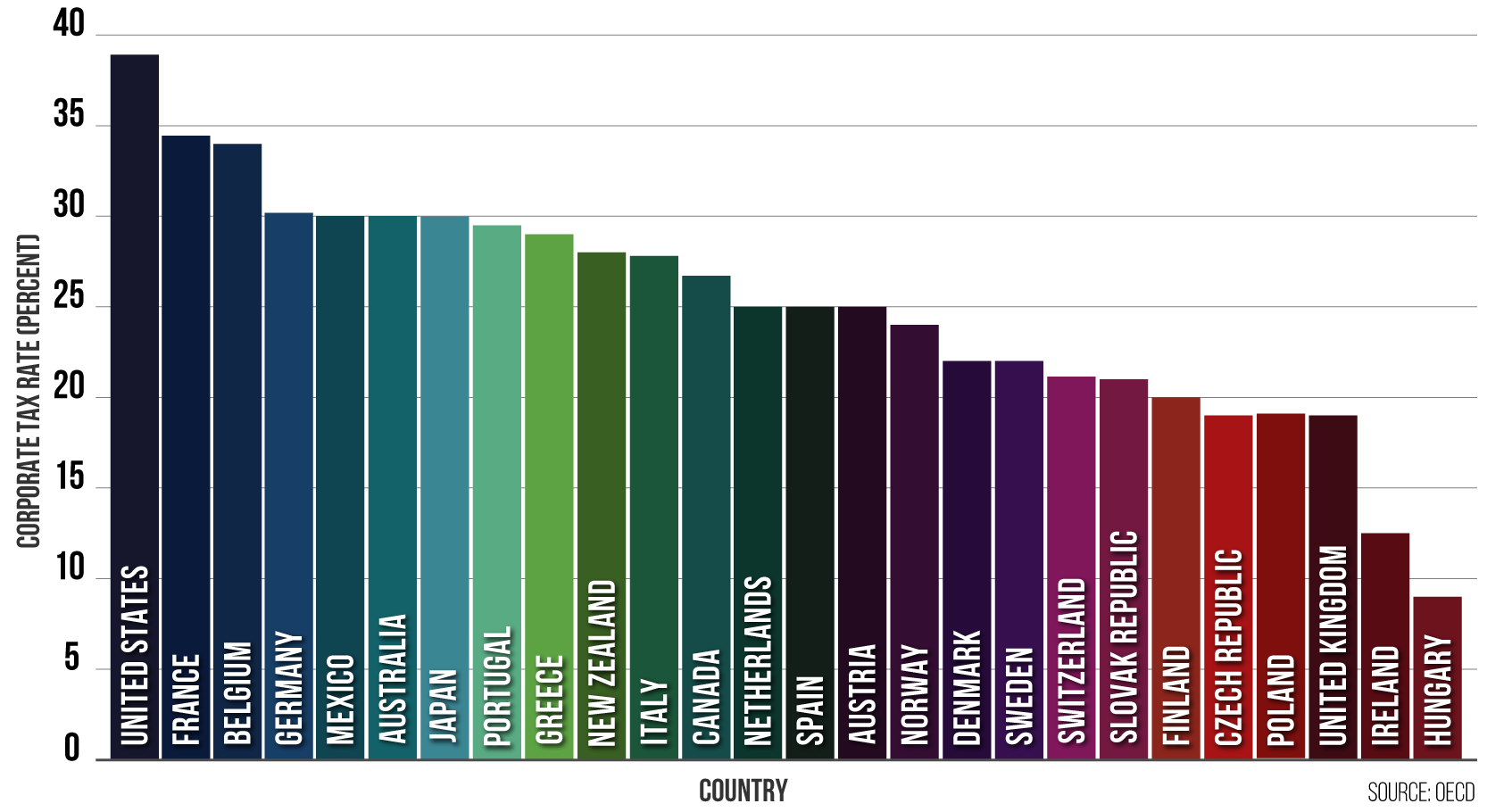

115-97 replaced the graduated corporate tax structure with a flat 21 corporate tax rate and repealed the corporate alternative minimum tax AMT effective for tax years beginning after December 31 2017. Japan Corporate Tax Rate table by year historic and current data. Dollar posts weekly gain.

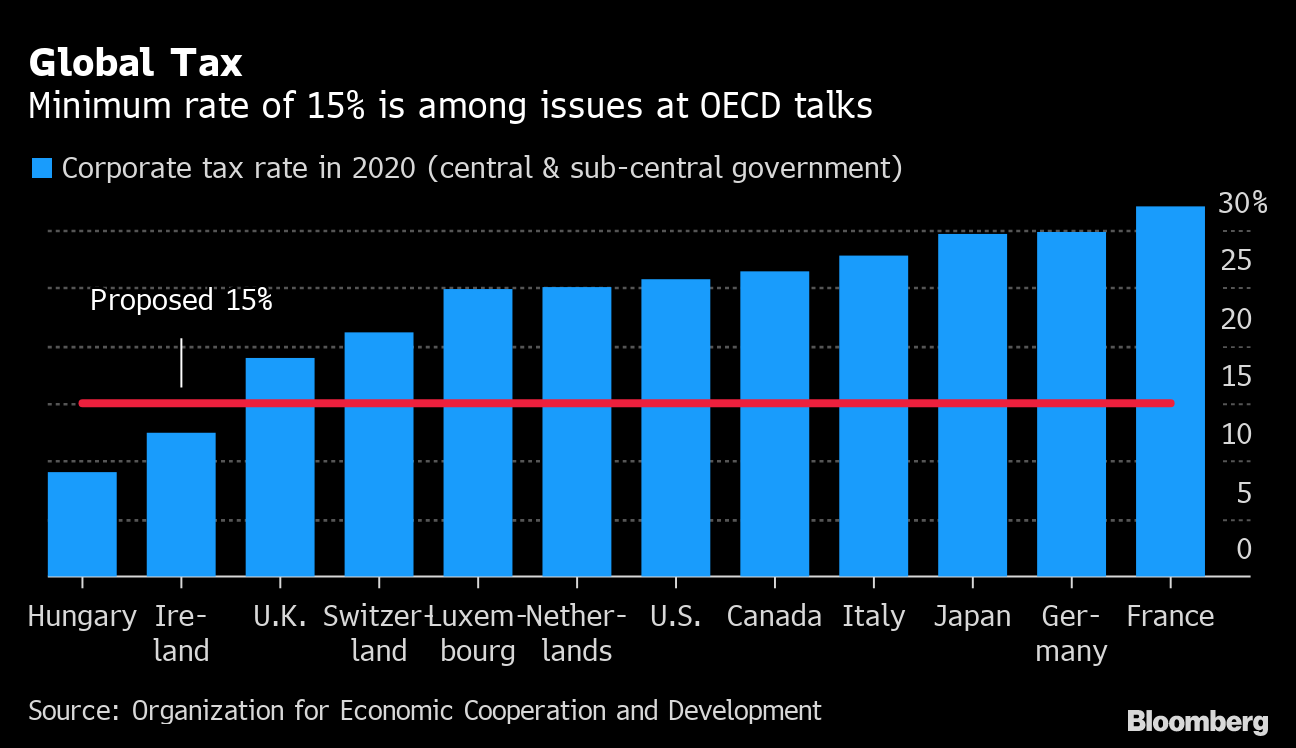

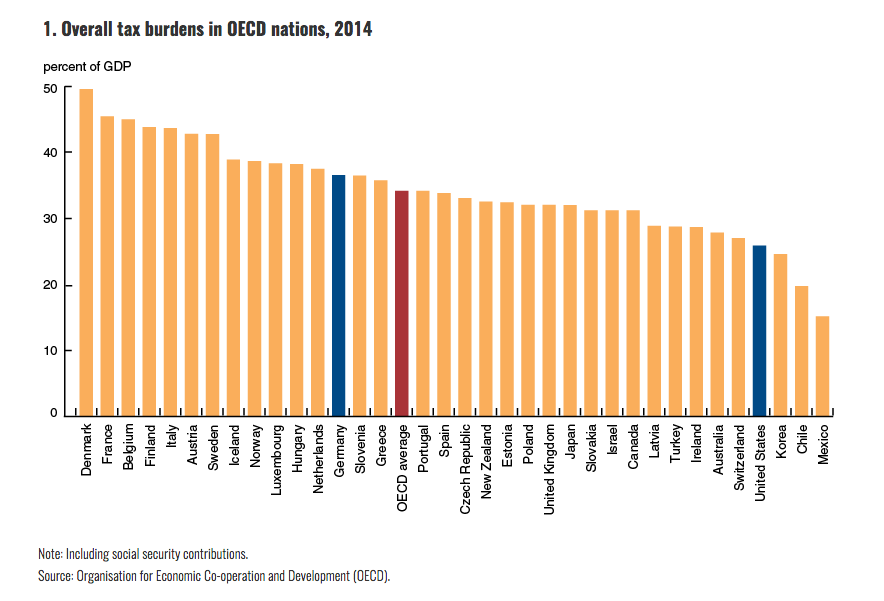

Employer Social Insurance Contribution Rate. OECD member states have an average statutory corporate tax rate of 2418 percent and a rate of 3112 when weighted by GDP. Local management is not required.

Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. However under section 15 corporations with fiscal tax years beginning before January 1 2018 and. For fiscal periods beginning on or after 1 April 2015 until 31 March 2017 an RD tax credit of generally between 8 and 10 of RD expenditure is available up to 25 of corporate taxable.

The G7 which is comprised of the seven wealthiest nations in the world has an average statutory corporate income tax rate of 2957 percent and a weighted average rate of 3348 percent. This tax calculator is used to assess what amount is the crossover point where its more beneficial to classify income from investment property as personal or corporate in order to. Local corporation tax applies at 44 percent on the corporation tax payable.

The corporation tax is imposed on taxable income of a company at the following tax rates. Japanese income tax can be sometimes confusing and difficult to understand. 55 of taxable income.

National Health Insurance Rate. Effective Corporate Tax Rates With Alternative Rates of Inflation in G20 Countries 2012 35 Figure B-3. Tax base Small and medium- sized companies 1 Other than small and medium-sized companies Taxable income up to JPY8 million in a year 19 15 2 234 3 Taxable income in excess of JPY8 million 234 3.

Japan Income Tax Rates and Personal Allowances in 2019 No Votes The income tax rates allowances thresholds rates and other payroll deductions and allowances displayed on this page are used by the 2019 payroll and tax calculators to calculate relevant tax deductions. Tax year beginning after 1 Apr 2018. Current Japan Corporate Tax Rate.

Tax rates for fiscal year filers. Effective Corporate Tax Rates With Uniform and Country-Specific Rates of Inflation in G20 Countries 2012 37 Figure B-4. A tax reform bill will be prepared based on the outline and is expected to be enacted by.

73 51 73 53 Over JPY 8 million.

Corporate Tax Reform In The Wake Of The Pandemic Itep

Corporation Tax Europe 2021 Statista

Is Us Highest Taxed Country As Trump Claims

Global Corporate Tax Overhaul Advances As 136 Nations Sign On Bloomberg

Corporate Tax Reform In The Wake Of The Pandemic Itep

Who Pays More In Taxes U S Vs Europe Developed Countries Money

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Be Cautious About Raising The Corporation Tax Rate Oxford University Centre For Business Taxation

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

High Corporate Taxes Hurt All Americans

Corporate Tax Remains A Key Revenue Source Despite Falling Rates Worldwide Oecd

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Is Us Highest Taxed Country As Trump Claims

G7 Backs Global Corporate Tax In First Step Towards Reform Economist Intelligence Unit

An Overview Of The Taxation Of Residential Property Is It A Good Idea Public Sector Economics